8 Steps to Streamline Your RFP Process

Introduction The Request for Proposal (RFP) process, often viewed as cumbersome and time-consuming, remains a crucial tool in sourcing goods...

Get 10€ off on your first order!

Optimizing procurement is key to successful purchasing and supply chain management. This involves understanding how supplier connections affect pricing and performance and updating your vendor list to meet standards. Companies aiming to cut costs invest significant time in improving their source to pay processes and finding the finest suppliers.

How much should strategic sourcing influence your buying? How do you evaluate vendors to get the best deals?

Learn about the source-to-pay process, how it differs from other procurement management methods, and how procurement software can help you reach strategic sourcing goals.

S2P covers all procurement project aspects. Identifying and evaluating new suppliers, purchasing, contract lifecycle management, supplier performance review, spend analysis, and accounts payable.

To always secure the best supplier terms and pricing, source-to-pay is vital. Source-to-pay helps companies evaluate vendors. They then purchase and pay for products, services, and software.

Simply put, procure-to-pay is part of source-to-pay. P2P focuses on purchase requisitions to final payment, while S2P starts with supplier management. S2P covers the crucial period between discovering a need and contracting with a supplier.

/package

/package

/package

/package

/package

/package

/package

/package

/package

/package

/package

/piece

/package

/package

/package

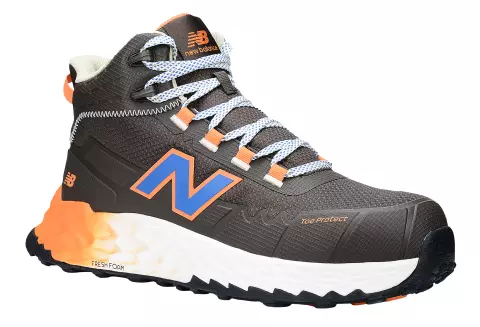

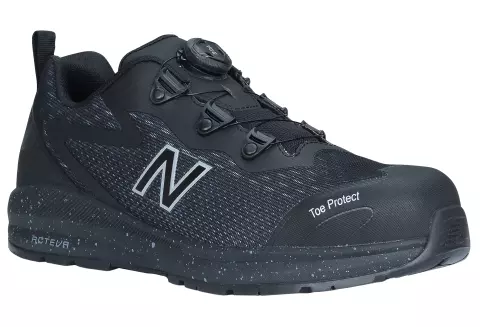

/pair

/pair

/package

/package

/package

/package

/package

/pair

/package

/pair

/package

/pair

/pair

/package

/package

/piece

/package

/package

/pair

/package

/package

/package

/package

/package

/package

/pair

/package

/package

/package

/package

/pair

/pair

/pair

/pair

Strategic sourcing helps companies maximise budgets. It assures they acquire the greatest pricing for goods, services, and software to advance the company.

Successful procurement requires a repeatable procedure. Each S2P project follows the same processes to get the right goods at the right price on time. Individual organisational processes may differ, but S2P normally follows:

E-auctions (e-actions) quickly match customers with the finest suppliers. Instead of waiting for RFQ responses, the buyer directly contacts various suppliers through an electronic clearinghouse. Suppliers compete for business in reverse auctions, lowering prices.

There are various types of electronic auctioning:

Reverse English: In a reverse English auction, all bidders know their competitive position. The item’s price is lowered by repeated bids until a winner is chosen. English auctions close “hard” or “soft”. In a hard close, bidding ends at a set time. A soft close (sometimes called a “dynamic” close) ends bidding after a defined time.

Reverse Vickrey: One-round lowest-and-best bidding. Several providers submitted electronic bids concurrently without knowing each other. Buyers choose the bid that best meets their needs.

Reverse Dutch: A “step” auction where the price rises over time. Initial bids are modest, then raised until a bidder takes the contract. First to accept contract price wins auction. Suppliers accept the best price before a competitor accepts the contract is encouraged.

Reverse Japanese: Another round-based “step” auction. The buyer sets a high price and gradually lowers it over a given number of intervals to find the lowest bid. At each stage, suppliers can accept or reject bids. After a certain amount of rejections, the provider is removed from auctions. This continues until one bidder remains, giving the buyer the lowest price.

Strategic sourcing improves procurement through cost reductions and spend optimisation. Top S2P benefits include:

Better sourcing strategy: An outdated list of recommended suppliers misses out on opportunity. Organisations can adapt to shifting procurement conditions by benchmarking pricing and assessing providers. This maintains vendor and price competition.

E-auctions enable faster fulfilment: E-auctions streamline supplier searches into a time-saving many-to-one process. More efficient order fulfilment results from faster and easier supplier selection.

Improved pricing and conditions: Competitive suppliers offer eager buyers better terms and pricing. Strategic sourcing (RFQ or e-auctions) motivates providers to win the contract. Better pricing stabilises cash flow and enhances spend control.

Better risk management: Evaluating new suppliers decreases organisational risk. A good supplier evaluation process uncovers issues and gives buyers a more detailed picture of the future partnership. Supplier evaluation assures regulatory and risk compliance and addresses cross-departmental requirements including contract wording, IT or InfoSec security minimums, and finance requirements.

Improved budgeting and forecasting: Understanding a deal’s financial components helps organisations comprehend its budgetary and practical effects. Knowing the best costs for commodities, services, and software helps stakeholders meet financial goals. Finance can use post-close reporting data to plan budgets, utilisation, and capacity.

Thank you! You've signed up for our newsletter.

Introduction The Request for Proposal (RFP) process, often viewed as cumbersome and time-consuming, remains a crucial tool in sourcing goods...

Introduction: Business Process Outsourcing (BPO) has transformed from a simple cost-saving measure to a strategic asset for companies of all...

Introduction: In business, “procurement” and “purchasing” are commonly used interchangeably, but they are different functions with different goals and processes....

Introduction The Request for Proposal (RFP) process, often viewed as cumbersome and time-consuming, remains a crucial tool in sourcing goods...

Introduction: Business Process Outsourcing (BPO) has transformed from a simple cost-saving measure to a strategic asset for companies of all...

Introduction: In business, “procurement” and “purchasing” are commonly used interchangeably, but they are different functions with different goals and processes....

Get 10€ off on your first order!

Save 30% by buying directly from brands, and get an extra 10€ off orders over €100

Save 30% by buying directly form brands, and get an extra 10€ off orders over €100