Data-Driven Insights: Transforming Procurement for Better Decisions

Introduction Data powers growth, efficiency, and competitive advantage in today’s fast-paced corporate environment. Procurement is crucial to every organisation. Fast-advancing...

Get 10€ off on your first order!

In today’s dynamic market, procurement teams must navigate price volatility that can affect operating costs and supply chain stability. Geopolitical developments, economic recoveries, and global crises affect commodities prices, requiring strategic preparation and adaptation. Procurement teams must understand price fluctuation reasons to reduce risks and grasp opportunities. The causes of price swings and six effective techniques to control procurement price volatility are discussed in this article.

Basically, anything may trigger market volatility. We’ve witnessed pandemics, war, famine, and recession in recent years. We may complete the collection when NASA finds a meteor on Earth’s crash course. Seriously, how does market volatility work? What causes price fluctuations?

/package

/package

/package

/package

/package

/package

/package

/package

/package

/package

/package

/package

/piece

/package

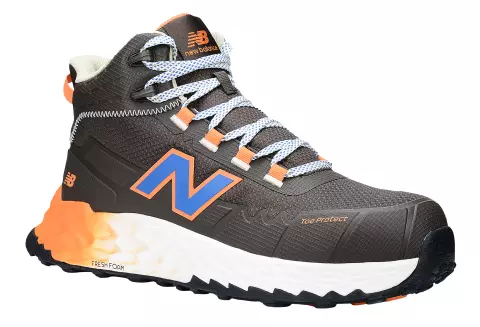

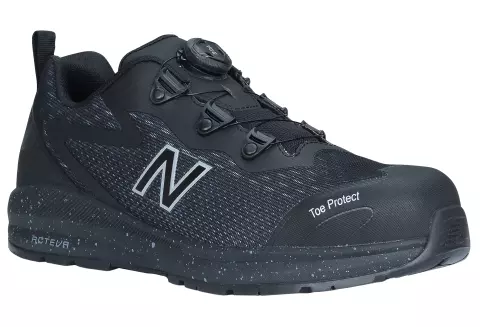

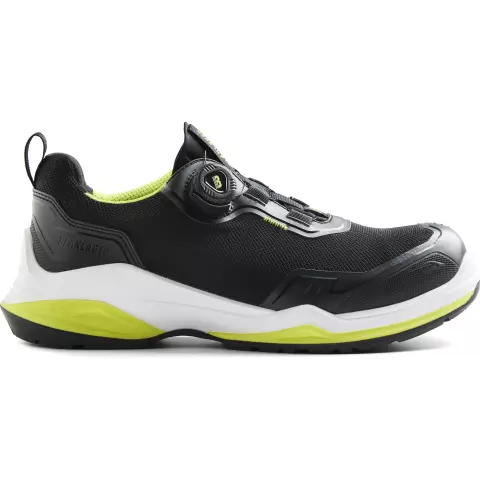

/pair

/pair

/package

/package

/package

/package

/package

/pair

/package

/pair

/package

/package

/package

/pair

/pair

/package

/piece

/package

/package

/package

/package

/pair

/package

/package

/package

/package

/package

/package

/pair

/package

/pair

/pair

/pair

/package

/pair

/pair

/package

/package

/package

As we know, supply and demand affect commodity prices. Anything that impacts commodity supply or demand changes the equilibrium price. Depending on supply and demand elasticity, the equilibrium price will vary.

Demand and supply have changed in 2020–2022, producing negative and rising pressures.

The epidemic curtailed travel, which lowered energy costs, while building businesses paused operations, lowering steel and timber prices. Commodities fell overall.

After the global economy rebounded, commodities markets saw increased demand and a lack of supply. During the crisis, commodities producers curtailed production to save fixed costs and could not expand up rapidly. Add to these supply chain problems from the Panama Canal blockade and the Ukraine war, and supply issues increased. Recovered commodity prices soared above pre-pandemic levels.

Price volatility sometimes stems from unusual market situations. A new corona virus and its variations sweeping the globe in 2020 were unexpected, and the invasion of Ukraine is hopefully an international aberration. But we can categorise such instances to understand the effects of comparable settings.

Weather and climate: Seasonal weather and temperatures affect fossil fuel consumption for home heating. Cold winters and high demand raise costs. Extreme weather reduces food supplies, raising prices; good growing conditions can provide a bountiful harvest, lowering costs.

war: International disruptions, such as the inability to produce in war zones or the adoption of sanctions on belligerent governments, would likely affect supply.

Reduced consumer spending and infrastructure investment usually lower demand and prices. And vice versa during economic recovery or growth.

General supply chain disruption: From blocked trade routes to component shortages, manufacturing or movement disruptions raise prices.

Naturally, each incident affects the global economy differently, especially when it comes to certain commodities like Ukrainian wheat output. The impact of each occurrence should be assessed individually.

Raw material costs account for 10–50% of product production costs. When you consider how oil prices affect logistics costs and inflation affects workers’ earnings, it’s clear how market volatility affects commodity pricing and any other item or service.

Rising commodity costs challenge an unprepared procurement department. Either margin will drop or sales prices must be raised, endangering consumer loyalty. But dropping prices provide equally significant issues.

When commodity prices decrease yet the procurement department is contractually bound to pricing agreed at a higher commodity price, the firm loses margin or market share by not lowering prices. The corporation may be undercut if a competitor has commodity-tracked buying prices. As market share declines, the corporation may face an existential crisis, similar to a margin pressure under rising commodity prices.

In addition to pricing, market volatility presents other issues. As said, supply concerns produce erratic pricing and markets, which might have the following effects:

Supply chain delays can cause contractual complications and lost business opportunities, putting client delivery dates at risk.

Competition with more profitable businesses: When commodities are scarce, more profitable sectors can afford higher commodity prices. Less lucrative industries suffer more.

The growth of low-cost competitors: As commodity prices rise, procurement and retail customers prioritise pricing. Low-cost competitors may beat a firm that delivers a premium product or service with intangible benefits.

Production planning uncertainty: Planners must take risks with unpredictable commodities. Overplanning production causes resource downtime and unneeded expense, while underplanning causes lost opportunities and expensive inventories.

In a world of supply and pricing unpredictability, how can a corporation succeed?

Price fluctuation doesn’t have to be bad for procurement. When managed well, it can provide you an edge over unprepared competition.

In conclusion, price volatility challenges procurement departments but also offers opportunity for those who can handle it intelligently. Organisations can safeguard margins, improve supplier relationships, and stay competitive by recognising pricing fluctuations and applying the necessary tactics. Proactive procurement may transform shocks into benefits, increasing resilience in a turbulent market. Successful procurement requires keeping knowledgeable and agile as the global economy changes.

Thank you! You've signed up for our newsletter.

Introduction Data powers growth, efficiency, and competitive advantage in today’s fast-paced corporate environment. Procurement is crucial to every organisation. Fast-advancing...

Introduction In today’s competitive corporate climate, indirect procurement (IP) is crucial to operational efficiency and cost control but sometimes disregarded....

Introduction In today’s fast-paced business environment, regulatory compliance often carries a stigma, viewed as an unnecessary burden rather than an...

Introduction Data powers growth, efficiency, and competitive advantage in today’s fast-paced corporate environment. Procurement is crucial to every organisation. Fast-advancing...

Introduction In today’s competitive corporate climate, indirect procurement (IP) is crucial to operational efficiency and cost control but sometimes disregarded....

Introduction In today’s fast-paced business environment, regulatory compliance often carries a stigma, viewed as an unnecessary burden rather than an...

Get 10€ off on your first order!

Save 30% by buying directly from brands, and get an extra 10€ off orders over €100

Save 30% by buying directly form brands, and get an extra 10€ off orders over €100