Achieving Success in Indirect Procurement: Step-by-Step Guide

Introduction: Procurement efficiency is crucial to the success or failure of a firm in today’s fast-paced commercial world. Any company...

Get 20€ off on your first order!

Businesses need the Procure-to-Pay (P2P) procedure to buy products and services and pay suppliers. This process must be optimised to boost efficiency, lower costs, and reduce mistakes. Businesses may improve procurement, supplier relations, and financial integrity by improving each P2P cycle stage. This article covers five key Procure-to-Pay process optimisation processes that promote operational excellence and reduce risk.

When was your latest procure-to-pay update? Business procedures must develop with organisations. Whatever your company’s procedure is, it might be improved.

/package

/package

/package

/package

/package

/package

/package

/package

/package

/package

/piece

/package

/package

/package

/package

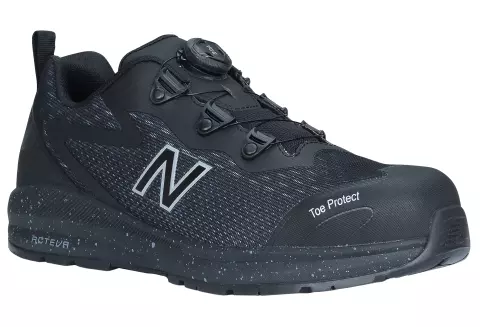

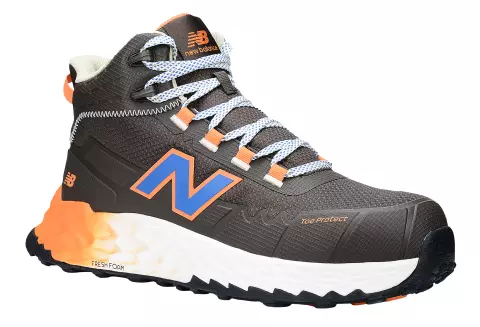

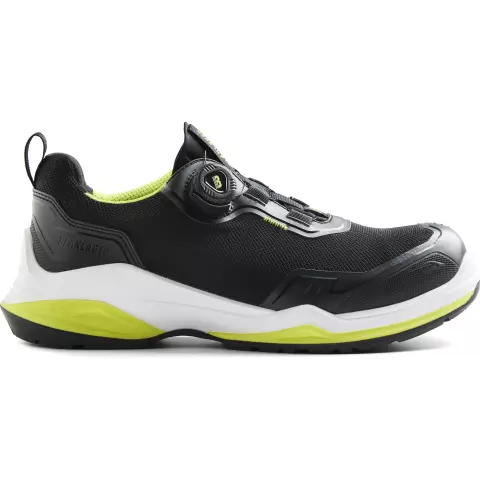

/pair

/package

/pair

/package

/package

/package

/piece

/package

/package

/package

/pair

/package

/package

P2P standardisation improves efficiency, reduces mistakes, and reduces fraud. With clear, uniform norms and protocols for purchasing, invoicing, and payments, firms may improve P2P transparency.

P2P procedures are standardised by establishing policies for requisitioning, authorising, invoicing, and paying. This ensures all transactions are processed methodically, eliminating mistake and fraud. Additionally, it speeds up decision-making and approval. Stakeholders know the actions and paperwork needed. Your finance and procurement staff will have more time for delicate or dangerous circumstances.

Standards help ensure compliance by ensuring all transactions follow internal control procedures and external regulations. It provides a comprehensive audit trail of procurement activity, making transactions, inconsistencies, and compliance concerns easy to evaluate.

Standardisation aids data analysis and administration. Consistent procedures generate data that may be gathered and analysed to reveal expenditure trends, supplier performance, and savings possibilities.

Standardising procure-to-pay procedures accelerates procurement and payment, improves financial controls, transparency, and insight for strategic decision-making.

procure-to–pay (P2P) is driven by supplier relationships. Working with suppliers is about building trust, respect, and shared goals—not only about handling contracts and transactions. During supply chain delays, supplier relationships may improve product quality, pricing, and service, thereby benefiting the business.

Clear communication is essential in solid supplier relationships. By means of meetings, phone, or digital channels, communication enables understanding of one another’s needs, expectations, and strengths. It also helps you to solve issues fast, hence reducing supply chain delays. Your performance might improve if you use the right tools and technology to interact with suppliers.

Management of suppliers depends critically on performance evaluation. By consistently comparing supplier performance against accepted criteria and KPIs, businesses may identify good service and fix issues. This motivates providers to exceed expectations and helps to maintain standards high.

At last, creative procure-to- pay solutions might result from supplier cooperation and innovation. Inviting vendors to participate on initiatives might uncover unanticipated value from process enhancements to cost savings, hence strengthening procurement strategy.

High-quality, accessible data helps procurement and finance teams make choices, monitor cost, and regulate the P2P cycle. Implementing systems and solutions that assure data accuracy, completeness, and consistency. In addition to uniformity and efficiency, this will save your finance staff time and stress.

Better visibility requires data centralisation. Organisations may reduce data silos and simplify data analysis by integrating procurement data into a single system. Centralisation improves transaction tracking from purchase order to payment and allows real-time procurement monitoring.

Regular data audits and cleanings are crucial. These methods preserve procurement data integrity by identifying and correcting mistakes, duplication, and obsolete information. Standardised data input processes and automation eliminate manual mistakes and boost data collecting efficiency. Data controls in Trustpair, best-in-class fraud protection software, maintain a healthy vendor database at all times.

Advanced analytics technologies boost the value of high-quality data. These technologies enable proactive procurement management and strategic decision-making based on trustworthy data by revealing expenditure trends, supplier performance, and possible bottlenecks.

Businesses that wish to improve efficiency, save costs, and stay competitive must constantly improve procure-to-pay (P2P). This method evaluates and improves the whole P2P cycle, from sourcing and procurement to payment and supplier relationship management. The procure-to-pay process should be nimble and linked with strategic goals.

Organisations must be proactive in finding inefficiencies and improvement opportunities. Stakeholder input from suppliers, procurement teams, and finance departments can be used in regular audits and performance assessments. These evaluations can find bottlenecks, outmoded procedures, and new dangers.

Innovation and technology are key to continued progress. AI, machine learning, and blockchain can automate processes, improve data analytics, and secure P2P transactions.

An automated P2P solution can decrease manual mistakes, speed up processing, and increase procurement visibility. Electronic purchase orders, invoices, payments, and matching and approval procedures can be automated.

Some of your procedure can be automated with software. It also eliminates labour costs and human faults that would be irreparable if done manually. Anti-fraud software like Trustpair ensures a secure procure-to-pay procedure.

Account data should be checked before every money transfer for safety. Manually doing so is time-consuming and error-prone. It would be nearly hard to constantly verify all supplier information. Our system instantly compares third-party data to international data. Machine learning lets us swiftly recognise unusual activity and warn your dashboard.

In essence, improving operational efficiency and guaranteeing financial transactions depend on optimising the Procure-to- Pay system. Standardising procedures, developing strong supplier relationships, enhancing data visibility, preserving continuous improvement, and using automation can help companies to simplify procurement operations and lower risks. By applying these best practices, you not only increase productivity but also strengthen your financial operations against fraud and mistakes, therefore guaranteeing a more agile and compliant company. Adopting these techniques helps your organisation to be successful over the long run in a competitive corporate climate.

Thank you! You've signed up for our newsletter.

Introduction: Procurement efficiency is crucial to the success or failure of a firm in today’s fast-paced commercial world. Any company...

Introduction In a fast changing global economy, firms face supply chain disruptions, fluctuating markets, and unexpected demand. Managing these difficulties...

Introduction Data powers growth, efficiency, and competitive advantage in today’s fast-paced corporate environment. Procurement is crucial to every organisation. Fast-advancing...

Introduction: Procurement efficiency is crucial to the success or failure of a firm in today’s fast-paced commercial world. Any company...

Introduction In a fast changing global economy, firms face supply chain disruptions, fluctuating markets, and unexpected demand. Managing these difficulties...

Introduction Data powers growth, efficiency, and competitive advantage in today’s fast-paced corporate environment. Procurement is crucial to every organisation. Fast-advancing...

Get 10€ off on your first order!

Save 30% by buying directly from brands, and get an extra 10€ off orders over €100

Save 30% by buying directly form brands, and get an extra 10€ off orders over €100