8 Steps to Streamline Your RFP Process

Introduction The Request for Proposal (RFP) process, often viewed as cumbersome and time-consuming, remains a crucial tool in sourcing goods...

Get 20€ off on your first order!

Process management in an organisation is complicated and ever-changing, requiring time and effort to complete and document. Financial tracking and staff request evaluation can become onerous without sufficient oversight. However, less than half of companies formalise business process management to streamline and manage these operations. Unspoken truth behind that? Investing in process automation gives organisations an edge. It improves worker satisfaction, decreases costs, and lets smaller enterprises compete with industry heavyweights. Which process is easiest and most advantageous to formalise? Approval process. We’ll cover the basics of improving approval processes today:

All approval processes, from petty cash purchases to annual budgets, require some basic characteristics.

Documentation: Document your purchase or request from start to finish, ensuring compliance and proof of due diligence. Key documents include purchase orders, invoices, contracts, payment authorizations, and stakeholder communications. Recording each approval stage enhances accounting control and data quality.

Approvers: Approvers validate purchase or budget requests. Typically, requests pass through the requesterâs supervisor, department head, finance, legal, and security staff. For major purchases, C-suite executives may be involved. Multiple approvers ensure thorough evaluation, reducing waste and fraud.

Permissions policy: A clear permissions policy is vital. It assigns roles and responsibilities, preventing fraud and misuse. Only authorized personnel should approve invoices. The policy should specify who can access and update information, safeguarding financial integrity.

Performance deadlines: Due dates in approval processes keep everyone on track and prevent delays. Since each approval stage has a schedule, deadlines help streamline workflows. This expedites approval requests and prevents process bottlenecks.

Performance dates are crucial when approvals are related to project management milestones, RFP deadlines, or other critical events. Setting deadlines prioritises internal activities and holds employees accountable for achieving them, boosting productivity.

Approval reporting: Tracking and recording all approvals during an approval process is approval reporting. Approvers explain decisions. Transparency helps stakeholders achieve quality control and regulatory compliance. The original requestor can follow their request and set completion expectations with approval reports.

Approval reports also show decision-making tendencies, helping organisations streamline their approval procedures.

Each approval process follows the same order: request, review, approve. Workflow details vary per approval process. A purchase approval may require numerous approvals, while a small-dollar invoice approval may only require one.

/package

/package

/package

/package

/package

/package

/package

/package

/package

/package

/package

/package

/package

/package

/piece

/package

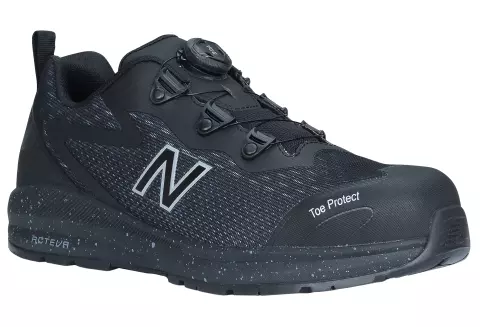

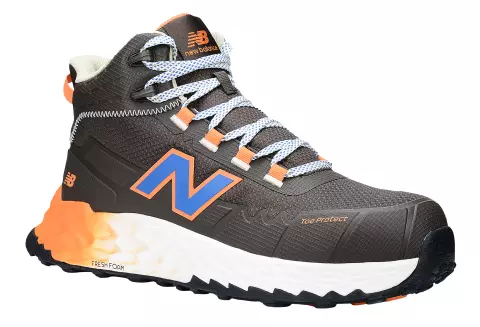

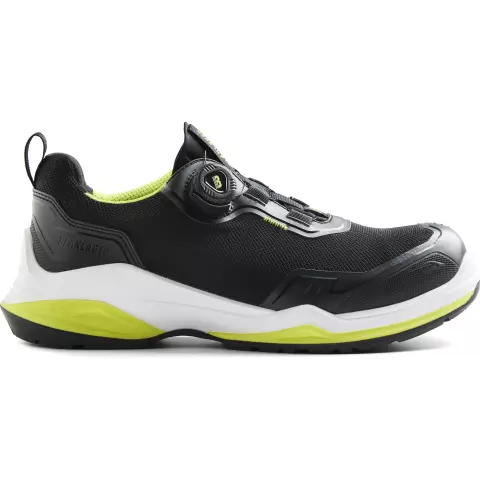

/pair

/pair

/package

/package

/package

/package

/package

/package

/package

/pair

/pair

/package

Some organisations have many approvers at each spend or request level before the request moves forward.

Some companies automate approval operations with financial and time constraints. Careful planning and clear communication are needed to ensure stakeholders understand how their requests will be handled, regardless of approval process.

Digital approval automation improves invoice and request workflows. Organisations reduce paperwork, improve communication, and follow progress in real time by automating approval steps. Automation ensures all procedures are followed, reducing errors and guaranteeing an invoice is exact before payment. This automated method speeds up invoice processing, freeing up time for other duties.

Although approval generally comes to mind spending, process and automation aid an organisation in other ways. Companies can improve results by systematising and automating several procedures.

Creative: Marketing managers and creative teams must plan carefully for the multi-step content approval process to guarantee stakeholder buy-in to the strategy and budget. Creative campaigns spend more and leave a lasting impression, thus such procedures are crucial.

A detailed proposal detailing objectives, risks, timing, budget, and other pertinent information is customary for this approval procedure. The relevant stakeholders decide if this should proceed. Content writers, video teams, graphic designers, and others execute the work after marketing managers and strategists set briefs and goals.

Employee leave: Leave requests affect every element of the organisation, from production to financing. Employee leave is carefully documented with an approval process. This helps managers create contingency plans and prevent workflow disruption. A clear leave clearance process aids Finance in budgeting and compensation.

Purchases: Purchase approval processes ensure that the expenses are budgeted and essential for the organisation. They begin with an end-user request and go through budget and interdepartmental approvals. The purchase clearance procedure keeps spending within budget and policy. Purchasing approvals reduce maverick spend and manage indirect cost, a business’s most expensive category.

Budgets: Annual budgeting requires stakeholder discussion and consent across the firm. This method assigns budget pools, restrictions, and constraints. The purchasing approval process begins with budget approval, which defines spending limits and procedures.

Invoicing: Invoice approval tracks company spending and authorises all invoices. Checking the invoice to the purchase request or order is typical. Fraudulent purchases and unapproved revisions to accepted requests are prevented by invoice approval. Invoice approvals start back-end payment and AP operations.

An invoice approval process authorises payment. This procedure may involve department heads, accounts payable leaders, procurement, and the CFO. They collaborate to verify bills before payment.

When an invoice arrives by mail or email, the approval procedure begins, but a need must be determined first. A fast and effective accounting and procurement process requires an end-to-end invoice validation process that gathers data at the start.

Planning your approval steps before implementing them is crucial. Planning ensures stakeholders understand the process and their roles. Automation can improve workflow management, save time, lower labour costs, and eliminate errors.

Build your first or future approval procedure using these steps:

Without documentation, you can’t enforce a policy. The best companies document all policies, including approval processes. Purchase approval procedures specify who can approve orders, what information is required, and what happens if the order and receipt differ. This verifies all invoices fast and accurately.

Dynamic approvals provide procurement just enough control. Consider these when designing your approval workflow:

Asking these questions helps you understand your approach and how it will support company procurement.

Having designated approvers ensures requests are considered in order by the proper persons. These approval steps prevent workflow bottlenecks. They also show who has fulfilled departmental approvals, helping you find stoppages immediately.

Determine who should make decisions for each approval procedure, such as:

Purchase or contract dollar value affects approval list and process. A high-value contract may require executive approval and security review. To streamline the process and free up higher-level approvers, department-level approval could be used for small, routine expenditures.

If requestors must follow a policy, provide a successful path. Assign initial submission steps to each request. Create an intake form or utilise a purchasing platform to let consumers describe their needs, outline solutions, and route requests.

A purchasing platform automates these operations by letting customers choose from a predesigned, selected list of vendors or items. It reduces request management’s time-consuming manual approval processes by setting spending limits, approval routing, and permissions.

The approval process should include a document retention system for convenient access to current and prior bills. Centralising invoicing and contracts simplifies contract research, negotiation, vendor selection and onboarding, and procurement management.

Effective purchase approval steps

Companies’ operational and financial health depend on invoice approvals. Proofs of bill and products accuracy are needed to trust your invoice approval process.

1. Purchase order: A purchase order is different from a purchase request. The invoice verification procedure begins with this document. The whole purchase order should include:

This information will be used to construct the purchase order, vendor documentation, invoice, and payment.

2. Approval: Once submitted, the request goes through an internal approval process before reaching accounting. This ensures thorough checks are performed to prevent fraud. Reviewers assess purchasing risks before approving each order.

3. Purchase order: Accounting prepares the purchase order (PO) based on the initial request and departmental approvals. The vendor reviews the PO, signs off, and confirms fulfillment. For net terms purchases, the vendor invoices with a repayment period. Otherwise, full payment is due upon receipt.

4. Fulfillment and receipt: The seller fulfills the order, providing a receipt manifest or other documentation. The receiving department verifies the items against the purchase requisition, PO, and invoice through a three-way matching process.

5. Payment: After fulfillment and matching, accounting finalizes the invoice and schedules it for payment. Software automates the entire billing process, creating documentation for reporting, tracking, and performance management.

Thank you! You've signed up for our newsletter.

Introduction The Request for Proposal (RFP) process, often viewed as cumbersome and time-consuming, remains a crucial tool in sourcing goods...

Introduction: Business Process Outsourcing (BPO) has transformed from a simple cost-saving measure to a strategic asset for companies of all...

Introduction: In business, “procurement” and “purchasing” are commonly used interchangeably, but they are different functions with different goals and processes....

Introduction The Request for Proposal (RFP) process, often viewed as cumbersome and time-consuming, remains a crucial tool in sourcing goods...

Introduction: Business Process Outsourcing (BPO) has transformed from a simple cost-saving measure to a strategic asset for companies of all...

Introduction: In business, “procurement” and “purchasing” are commonly used interchangeably, but they are different functions with different goals and processes....

Get 10€ off on your first order!

Save 30% by buying directly from brands, and get an extra 10€ off orders over €100

Save 30% by buying directly form brands, and get an extra 10€ off orders over €100