Supplier Verification: Key to Ensuring Quality and Reliability

Introduction In the ever-evolving landscape of small and medium-sized businesses (SMBs), ensuring a reliable and high-quality supply chain is paramount...

Get 20€ off on your first order!

Monitoring a company’s finances extends beyond cash accounting. Third-party vendor fraud is rising in the digital age. More sophisticated fraud schemes require more rigorous fraud prevention.

Companies lose thousands in cash, legal fees, and financial influence due to fraud. In extreme cases, fraud damages credit and finances.

This article discusses vendor fraud and how organisations can prevent it. Several vendor fraud questions will be answered:

Suppliers commit vendor fraud by manipulating prices or commodities. Increasing internal earnings and embezzling money are the goals.

Different types of fraud exist. It may involve one bad actor or internal employee-vendor collaboration. Businesses face costly vendor fraud. The ACFE estimates that fraud costs companies 5% of revenue.

Internal staff and external vendors commit purchase fraud in several ways, some of which are harder to discover. In some cases, vendors instigate fraud through invoicing schemes or payment frauds. Internal employees sometimes receive bribes or other incentives from fraud. The majority of employee dishonesty is for personal benefit.

/package

/package

/package

/package

/package

/package

/piece

/package

/package

/package

/package

/package

/package

/package

/package

/pair

/pair

/package

/package

/pair

/package

/package

/package

/package

/package

/package

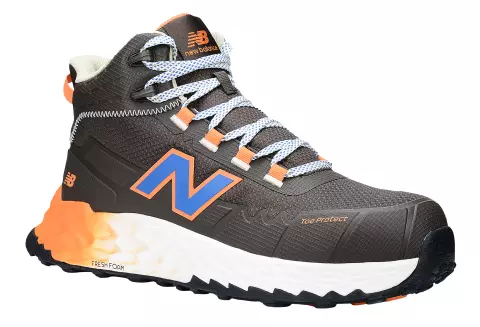

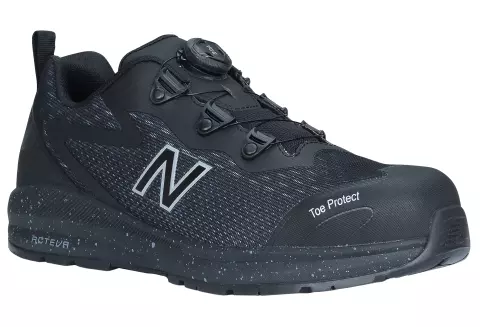

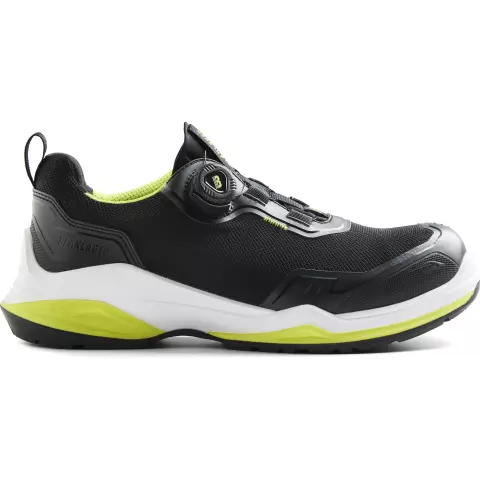

/pair

/package

Most firms must watch for many vendor fraud types.

When an inside employee and an external actor combine to steal corporate money, fake vendor payments occur. Fraudsters usually build a shell corporation and bank accounts.

The shell firm employee sends bogus invoices to the inside employee, who proceeds with payment. Another variation of this scam involves an internal actor changing a valid supplier’s account to transfer cash to a second account.

Check fraud is a common procurement scam due of its simplicity. Internal employee fraud involves obtaining vendor payment checks from business accounts. They modify the beneficiary or vendor signature to transfer funds to an unauthorised account.

Check fraud is most likely in manual, paper-based payment processing companies. This scam may be hard to detect without forensic accounting.

Most duplicate payments are accidental. However, invoice duplication allows vendor fraud in less secure accounting systems. A criminal alters the vendor account, sending the double payment to an external account. If the accounting system cannot detect or prevent duplicate, then fraud can occur again.

This scam can happen without an internal actor. This merchant adds products or services to invoices to inflate them. Buyers pay for goods and services they never obtain.

Price fixing is a less prevalent but more subtle form of deception in which numerous rivals in a market or industry jointly increase their prices to appear competitive. The FTC prohibits price fixing. Even if the fixed price is not premium, this behaviour is anti-competitive and illegal.

Many fraudulent vendor actions have hallmarks. Meeting one of these characteristics does not imply fraud, but meeting multiple may necessitate additional security research:

If a trustworthy vendor seems questionable, examine the issue and engage with them to resolve it. If a corporate card or account fraud cannot be resolved with the vendor, contact the card issuer or bank.

Fraud detection is difficult in manual accounting. Use these recommended practices to reduce fraud risk and improve detection.

Spend time researching new vendors. A uniform onboarding and risk assessment approach for new suppliers in your organisation. Establish a risk profile at the start of the supplier relationship with a security questionnaire.

A foolproof approval process is the finest fraud defence. To avoid fraud, require multi-step permission for purchases and invoice payments. Your approval workflow should compare the purchase order or requisition to the bill of lading and vendor invoice. Protects against inflated or erroneous bills.

Increase accounting spend analysis and reporting. You optimise cash and make fraud unattractive. Best practices and software can provide line-level expenditure information and eliminate third-party vendor risk.

Decentralised accounting allows financial activity concealment. Creating a central vendor database provides accurate address and account information. This stops internal actors from changing shipment addresses or external bank accounts without notification.

Pre-authorized lists of verified vendors ensure that all supply chain vendors are validated and approved.

One of the finest fraud defences is automatic account change and suspicious behaviour detection. This includes duplicate identification, vendor change notifications, and spend analysis to identify anomalies.

Many manual fraud-enabling processes are automated by procurement or vendor management systems.

Thank you! You've signed up for our newsletter.

Introduction In the ever-evolving landscape of small and medium-sized businesses (SMBs), ensuring a reliable and high-quality supply chain is paramount...

Introduction: In today’s highly competitive business environment, cost reduction is a top priority for procurement professionals. However, achieving this goal...

Introduction: In today’s fast-paced manufacturing landscape, effective communication with suppliers is crucial for maintaining operational efficiency and meeting customer demands....

Introduction In the ever-evolving landscape of small and medium-sized businesses (SMBs), ensuring a reliable and high-quality supply chain is paramount...

Introduction: In today’s highly competitive business environment, cost reduction is a top priority for procurement professionals. However, achieving this goal...

Introduction: In today’s fast-paced manufacturing landscape, effective communication with suppliers is crucial for maintaining operational efficiency and meeting customer demands....

Get 10€ off on your first order!

Save 30% by buying directly from brands, and get an extra 10€ off orders over €100

Save 30% by buying directly form brands, and get an extra 10€ off orders over €100